reverse sales tax calculator nj

New Jersey sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. You can use an online reverse sales tax calculator or.

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Find list price and tax percentage. With QuickBooks sales tax rates are calculated automatically for each transaction saving you time so you can focus on your business.

This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. To use the sales tax calculator follow these steps. The flat sales tax rate means you will pay the same rate wherever you are in the state with two exceptions.

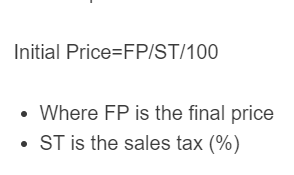

PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes. You can also calculate your property taxes with our New Jersey property tax calculator. The only thing to remember in our Reverse Sales.

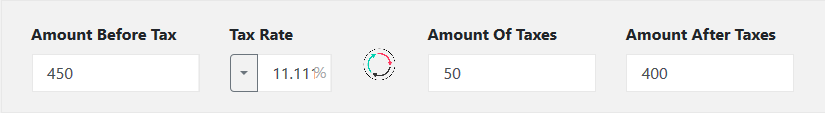

Dated on or after January 1 2018 the tax rate is 6625. We can not guarantee its accuracy. Input the Before Tax Price price without tax added on.

Most transactions of goods or services between businesses are not subject to sales tax. I have included the following reverse sales tax calculator for calculating the before-tax price and sales tax amount from the final amount paid. Then use this number in the multiplication process.

See also the Reverse Sales Tax Calculator Remove Tax on this page. New Jersey has a 6625 statewide sales tax rate but also has 312 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0003 on. The current total local sales tax rate in Montrose NY is 8375.

Not all products are taxed at the same rate or even taxed at all in a given. A tax of 75 percent was added to the product to make it equal to 482675. Start filing your tax return now.

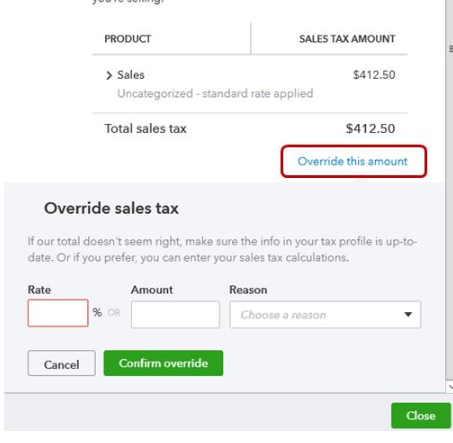

Check out flexible QuickBooks sales tax software for your business to track sales sales tax and cash flow. Formulas to Calculate Reverse Sales Tax. For the second option enter the Sales Tax percentage and the Gross Price of the item which is a monetary value.

Sales tax calculator to reverse calculate the sales tax paid and the price paid before taxes. That entry would be 0775 for the percentage. If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax.

Calculate net price and sales tax amounts. Type here OR. This calculator will help you decide if making bi-weekly mortgage payments is right for you.

New Jersey has a single statewide sales tax rate. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. New Jersey NJ 6650-0030.

Sales tax rates can change over timethe calculator provides estimates based on current available rates. The base state sales tax rate in New Jersey is 6625. Find your New Jersey combined state and local tax rate.

Complete the top 5 entry fields and click the Compute button. New Jersey Sales Tax. Sales Tax total value of sale x Sales Tax rate.

Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price or in reverse from a tax-included price. Reverse Sales Tax Calculator to calculate price before tax and the tax amount based on the final price and sales tax percentage.

There are two options for you to input when using this online calculator. Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. Before Tax Price.

Divide tax percentage by 100 to get tax rate as a decimal. Tax can be a state sales tax use tax and a local sales tax. If services were completed between January 1 2017 and December 31 2017 but the bill is rendered eg.

48268 1075 449. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. So divide 75 by 100 to get 0075.

Use this app to split bills when dining with friends or to verify costs of an individual purchase. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. Divide the tax rate by 100.

Facebook Twitter Youtube Instagram. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Add one to the percentage.

Enter the sales tax percentage. Try our FREE income tax calculator. 6875 regardless of whether or not the agreement covers periods after January 1 2018.

Property Information Property State. If you are entering data for a future mortgage you can leave the Current monthly mortgage payment field blank and the calculator will compute the payment for you. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent.

How to Calculate Sales Tax. Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663. Please check the value of Sales Tax in other sources to ensure that it is the correct value.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. Multiply the price of your item or service by the tax rate. Divide the final amount by the value above to find the original amount before the tax was added.

1 2018 that rate decreased from 6875 to 6625. New Mexico NM 5125. Welcome to the TransferExcise Tax Calculator.

Here is the Sales Tax amount calculation formula. Denotes required field Calculate. Input the Tax Rate.

Our free online New Jersey sales tax calculator calculates exact sales tax by state county city or ZIP code. For the first option enter the Sales Tax percentage and the Net Price of the item which is a monetary value. TAX DAY NOW MAY 17th - There are -377 days left until taxes are due.

1 0075 1075. Sales of Services. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

How To Calculate Sales Tax In Excel Tutorial Youtube

Sales Tax Reverse Calculator Internal Revenue Code Simplified

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Reverse Sales Tax Calculator 100 Free Calculators Io

Us Sales Tax Calculator Reverse Sales Dremployee

New Jersey Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator 100 Free Calculators Io

Us Sales Tax Calculator Reverse Sales Dremployee

State Corporate Income Tax Rates And Brackets Tax Foundation

Reverse Sales Tax Calculator Calculator Academy

Sales Tax Recovery Reverse Sales Tax Audit Pmba

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator De Calculator Accounting Portal